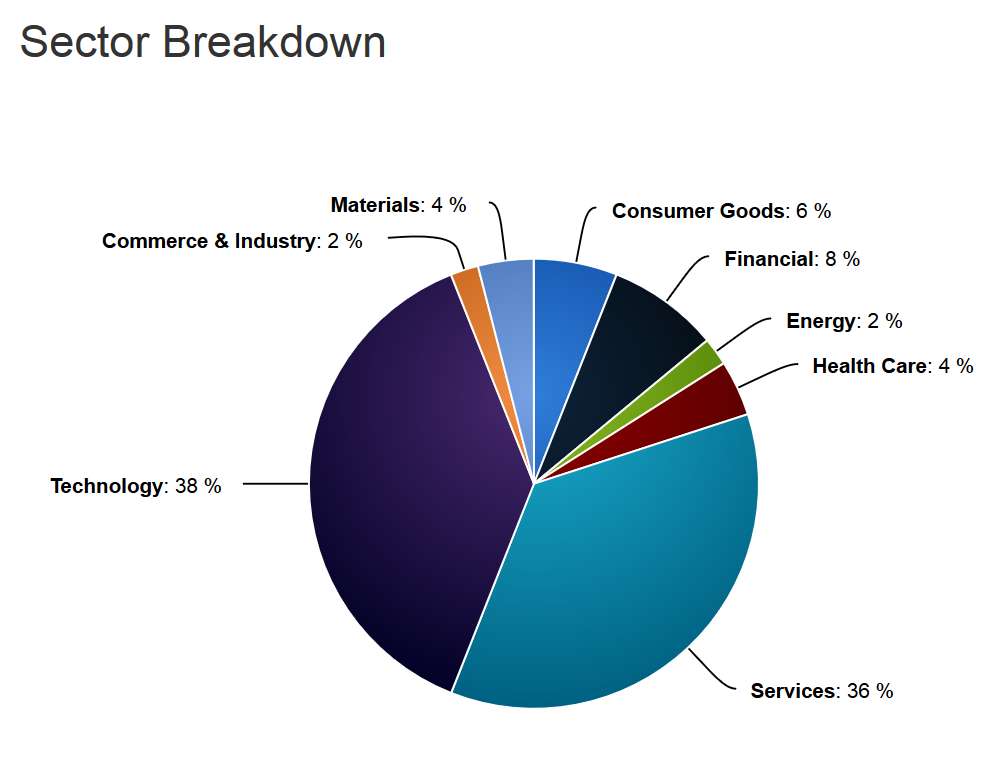

The CNBC Crowdfinance 50 Index is a new tool created to gain better insight into the emerging crowdfunding market. This index represents the daily average index of the 50 largest capital commitments raised by private U.S. companies listed on Crowdnetic's data platform. Crowdnetic collates real-time offerings from 16 crowdfunding sites including Patch of Land. Companies represented on the index are operating companies raising money, not equity funds. They represent eight sectors: commerce and industry; consumer goods; energy; finance; health care; materials; services and technology.

The Crowdfinance 50 Index signifies the emergence of crowdfunding as a massive economic power for raising capital. The index also brings mainstream exposure to the crowdfunding phenomenon which has exploded since the JOBS Act. Patch of Land is proud to be one of the companies representing the real estate crowdfunding data being aggregated by Crowdnetic for CNBC's Crowdfinance 50 Index. We look forward to helping this new industry establish credibility, gain exposure, increase knowledge and awareness, and grow for years to come. Take a look below at the different sectors being tracked, along with their correlating data graphs.

Related Article: Crowdnetic's Jim Jones Interviews AdaPia d'Errico

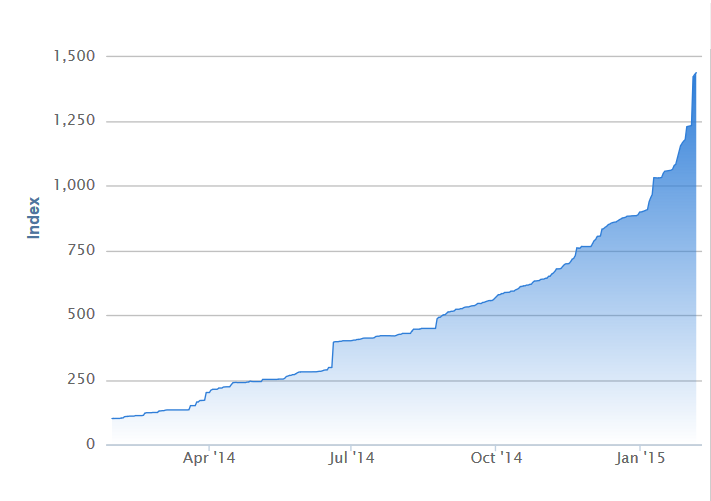

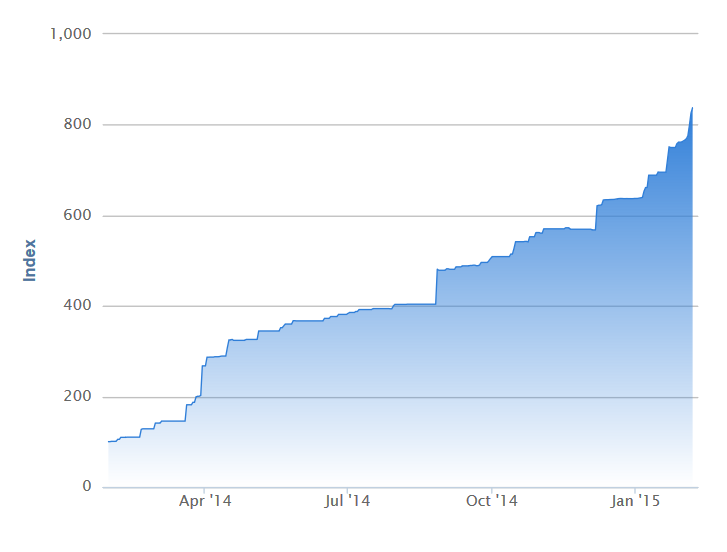

The CNBC Crowdfinance Real Estate Average

The CNBC Crowdfinance Real Estate Average is a daily arithmetic average of total capital commitments in excess of $1,000 raised by private U.S. real estate companies listed on Crowdnetic's data platform, which collates real-time deal-making on the following equity crowdfunding sites: Patch of Land, CrowdStreet, EarlyShares, Prodigy Network, RealCrowd, Realty Mogul, Return on Change and SeedInvest.

Related Articles: The Growth of Real Estate in Crowdfinance

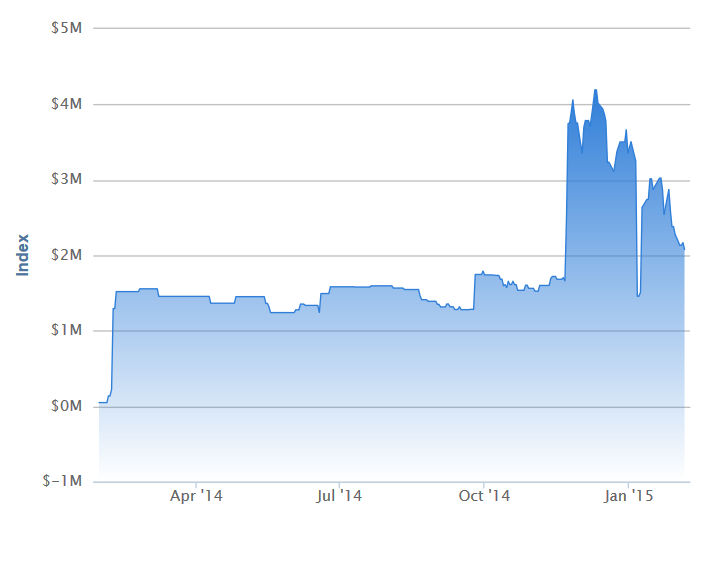

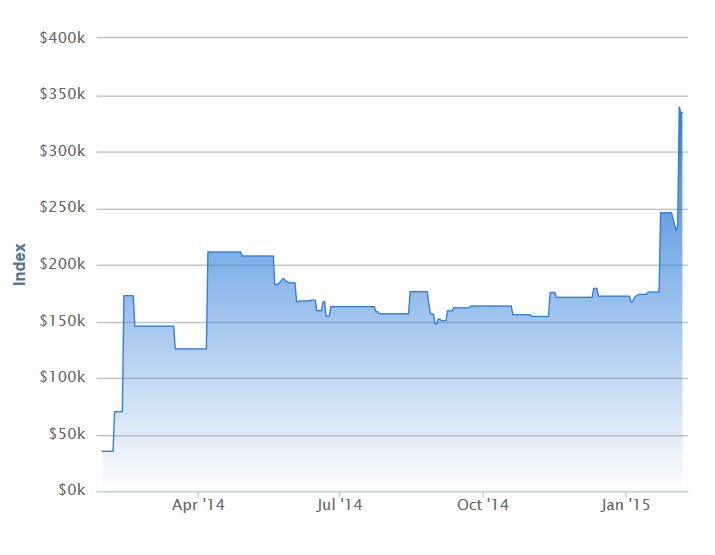

The CNBC Crowdfinance Services Index

The CNBC Crowdfinance Services Index is a daily average index of the 25 largest capital commitments raised by private U.S. services companies listed on Crowdnetic's data platform, which collates real-time offerings on 16 equity crowdfunding sites: Patch of Land, Alchemy Global, AngelList, Crowdfunder, CrowdStreet, EarlyShares, EquityNet, LendZoan, MicroVentures, Prodigy Network, RealCrowd, Realty Mogul, RealPartner, Return on Change, SeedInvest and WeFunder. Companies represented on the index are operating companies raising money, not equity funds.

Related Article: SeedInvest Interviews Jason Fritton

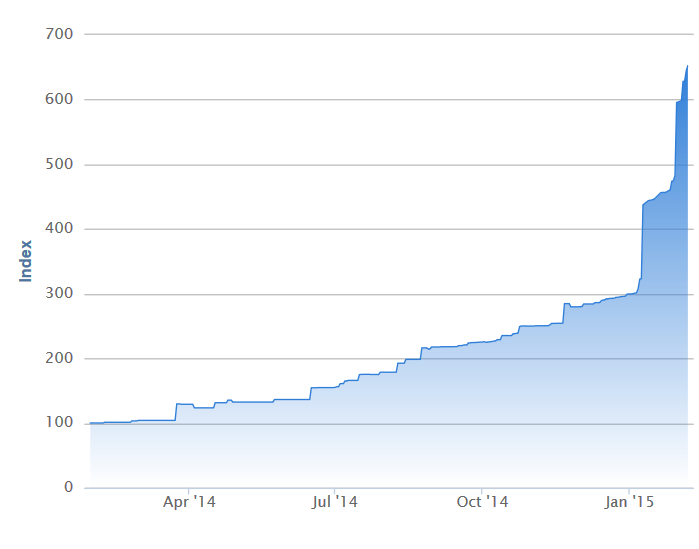

The CNBC Crowdfinance Technology Index

The CNBC Crowdfinance Tech Index is a daily average index of the 25 largest capital commitments raised by private U.S. tech companies listed on Crowdnetic's data platform, which collates real-time offerings from the following equity crowdfunding sites: Alchemy Global, AngelList, Crowdfunder, EarlyShares, EquityNet, MicroVentures, Return on Change, SeedInvest and WeFunder. Companies represented on the index are operating companies raising money, not equity funds.

Related Article: Why We Chose SeedInvest for Our Capital Raise

The CNBC Crowdfinance Vice Average

The CNBC Crowdfinance Vice Average is a daily arithmetic average of total capital commitments in excess of $1,000 raised by private U.S. companies listed on Crowdnetic's data platform, which collates real-time deal-making on the following equity crowdfunding sites: Alchemy Global, AngelList, Crowdfunder, EarlyShares, EquityNet, MicroVentures, Return on Change, SeedInvest and WeFunder. Companies on the average represent the following sectors: marijuana, adult entertainment, tobacco, nightclubs/services, gentlemen's clubs, alcohol, gambling, and firearms and weapons.

What are your thoughts on the emergence of the CNBC Crowdfinance 50 Index? Is this a good indication that the mainstream is accepting crowdfunding as a sustainable economical force within all industries? Please leave your comments below.

Note: Capital commitments represent the amount of capital that investors have indicated they would like to invest. Subject to the terms of the raise, investors may withdraw their interest before the closing date. In addition, and also subject to the terms of the raise, commitments might not come to fruition if the issuer does not meet its target by the closing date and the raise does not proceed.

Bill Huston commented April 6, 2015

Great data very insightful. Thanks for sharing this is great to know information for crowdfunding consultants and anyone planning to crowdfund!!

Gregory P. Coe commented December 28, 2015

I'm looking to start 2 Capital Funds. One 506 unlimited Regulation D Fund of $10,000,000 for Remodeling and new Building business and a Crowd Fund of $500,000 for a Paining and Stucco Subcontracting Business.

I would like to operate in California with the Reg D fund and The Crowd fund in Arizona Greg Coe 480-720-1406 Builders Investment Group LLC