Our Take on Alternative Investments

There are two classifications of investments available: traditional and alternative (a.k.a. non-traditional). Traditional investments are the usual stocks, bonds, and cash. Alternative investments include commodities that are more difficult to valuate such as: pieces of art, collectibles, and antiques, as well as hedge funds, venture capital-related projects, and finally, real estate.

A Better Option for Investors

Real Estate Investment Trust (REIT) investing is worth mentioning because it combines the accessibility of the stock market with the relative security of the real estate industry. However, REIT Investments often come with high fees (typically 15%) despite low returns. Additionally, stockholders have no control over which particular real estate projects the fund invests in. This also does not qualify as passive investing, as one would have to monitor the fund as they would any other stock on the market.

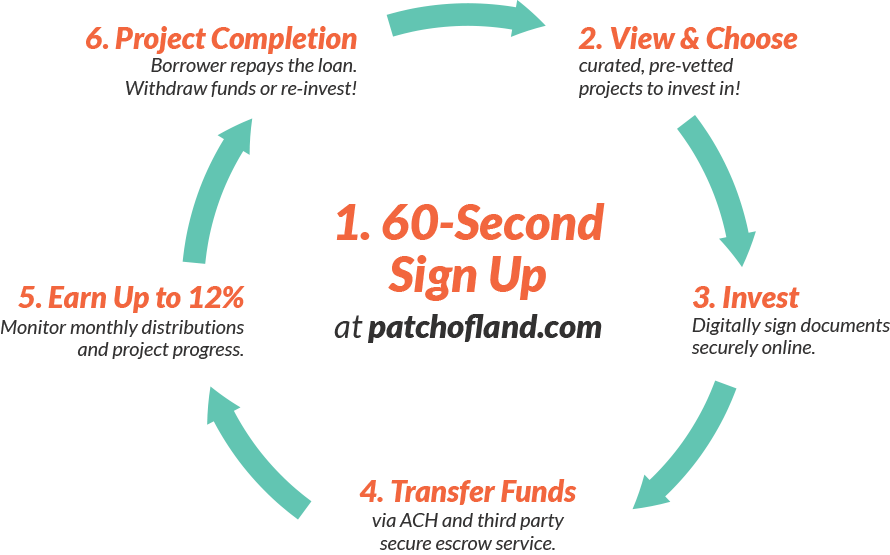

Patch of Land offers alternative investments in real estate to individual accredited investors and institutional investors who wish to augment their regular income with passive income by investing their money in cash-flowing, real estate loans. We offer investments in Real Estate Debt based on: Bridge Loans, Short-Term Transactional loans, and 1 – 12 Month Rehab and Refinancing Loans.

Unlike with REIT Investing, we actively encourage investors to exercise a lot of due diligence, and we make this easy by providing data, documentation, appraisals, etc. on every single project, property, and borrower. This allows the investor to choose exactly which of our pre-screened real estate investments fit their investment needs and diversification by yield, term, geography and project or loan type. In fact, you can gain insights as you invest in different projects by following our blog.

We choose only short-term debt investments, which can be considered safer than an equity position in real estate, as they are in the first position of repayment should there be a situation of a property losing value. We mitigate risks in many other ways, including a low after repair/rehab value (ARV), requiring that a borrower put down at least 20% into each project, etc. More details on risk mitigation is described directly on the investment page, as well as in our comprehensive FAQ

It’s Easy to Invest

For those who are interested in passive income investing with us, the basic criteria for an investor includes being verified as an accredited investor per the SEC.

Accredited investors are defined by the SEC as (1) an individual who has earned at least $200,000 annually for the past two years and reasonable expectation of earning at least that amount this year; (2) a couple that has earned $300,000 annually for the past two years and reasonable expectation of earning at least that amount this year; or (3) an individual with a net worth of more than $1 million excluding the value of his/her primary residence.

Investing with Patch of Land means you'll receive transparent, efficient, and comprehensive information on every single project throughout its entire duration. That way our investors can perform their own due diligence ahead of time, as well as receive ongoing support, information, and updates prior to, and after, investing.

Browse through our website to learn more about earning passive income from real estate investing. For further questions, refer to our FAQ page or kindly contact us.