Lending on residential rehab projects can be a relatively safe investment option- during both escalating and declining markets. At Patch of Land, we focus on rehab lending by providing low Loan to Value (LTV) on loans because we believe this to be the best way to mitigate risks and protect our investors.

The first step that Patch of Land takes in risk mitigation is by performing extensive due diligence on borrowers who have submitted loan requests through our platform. A key principle to adhere to, in any industry, is that you have to know who you are doing business with – whether it’s your partner or your borrower. Because many of our projects involve a significant rehab period, it is necessary for us to know about the borrower’s previous projects, including completed projects, existing projects, liabilities and the like. Choosing the most qualified real estate borrowers with an established track record greatly reduces the risk of future defaults of the loan.

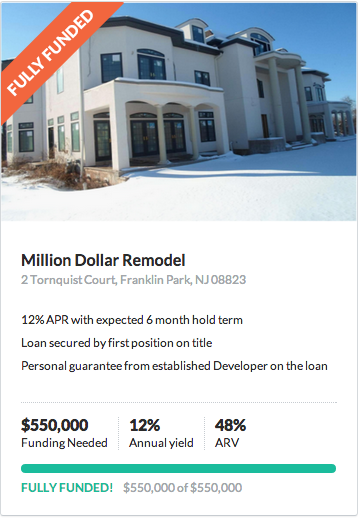

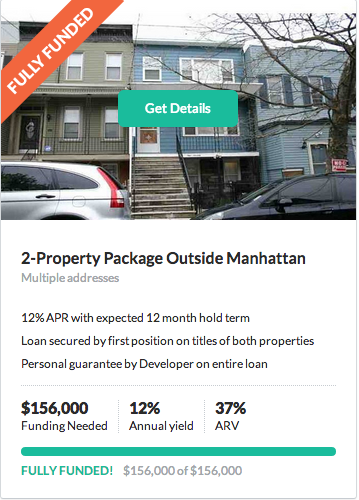

Patch of Land underwriters further mitigate the risk of each potential loan investment by taking a more conservative approach to value our projects. We want to choose appropriate real estate operators with enough collateral value to protect the lender in the worst-case downside risk scenario. In general, our team underwrites each loan [up to 80%] LTV because under such leverage, there is enough value in the collateral of the project to repay the loan. Providing high LTV loans allows for more risk, and we cannot control real estate prices when the rehab project is finished and put on the market for sale. For that reason, we believe a decent LTV underwriting approach is best to protect our investors.

This brings up a point that many loan investors might have: how can you justify lending 100% of the LTV of the “As-Is” value today? When evaluating such a project, it all comes down to making ‘risk-adjusted’ loan investments. Our risk mitigation process of extensive due diligence first, followed by a conservative LTV, is sequential and directly correlated for a reason. If the borrower has a stellar history of completing and selling rehab projects, you should not be alarmed with a 100% LTV of “As-Is”. Because it is a rehab project, the future value will increase, so today’s 100% LTV loan will [result in 70%] of the future completed value. This After Renovated Value, (ARV) calculation must certainly be supported by third-party opinion from outside appraisal companies, but overall, our principle is to focus on the borrower’s history first, then to understand the loan to future value ratio to see if it is sufficient for us (up to 70% ARV) to undertake the lending risk.

In essence, what we are trying to convey here is that rehab lending is a process originating from borrowers who, at the end of the day, need funding to improve a property, thereby improving the neighborhood and community. Keeping this principle in mind, we believe that a borrower’s track record holds great importance in underwriting loan decisions to protect our investors. This, along with conservative LTVs, can mitigate risks for investors- the very foundation of how and why we focus on rehab lending at Patch of Land.

This entry was originally published on July 30, 2014. It has been edited to fit today's LTV, ARV, and underwriting process.