Patch of Land is a peer-to-peer real estate (P2RE) platform offering debt-based real estate-backed securities to institutional and accredited investors. Our investments are secured by first position liens and personal guarantees; investments can be made with as little as $5,000 with NO investor fees. Our platform features a secure portal, and our Company focuses on compliance with all SEC, tax, and anti-money laundering regulations, giving all of our investors the confidence to move forward in secured real estate investments in 10 minutes or less.

Each potential investor is given the due diligence information and portfolio management tools needed to analyze each investment to arrive at a decision, based on their own personal risk profile. With transparency being paramount, incorporating a high level of automation allows Patch of Land to provide efficient financial, operational, and due diligence processes that facilitate data-driven decisions for our investors.

As an investor, you can log in to see current, as well as past, offerings. Why do we provide historical offerings? It’s simple – transparency.

Whether you are a developer, seasoned investor, or new to the game, Patch of Land strives to make the investment process easy and simple.

What are you investing in?

When you choose to make an investment in a Patch of Land “project”, you are purchasing a fraction of a debt note issued by Patch of Land. The payment of that note is based on the underlying property that is being refinanced, remodeled or rehabbed. Through this investment in the debt instrument, you receive monthly interest payments based on that loan’s fixed rate, as listed on the project page. With Patch of Land, instead of purchasing an equity stake in property and taking a last-in-line mortgage position, you lend lend money to developers and take a first lien position. When the developer finishes construction or rehabilitation and sells the property, your principal is returned along with any outstanding interest.

Platform use for investors:

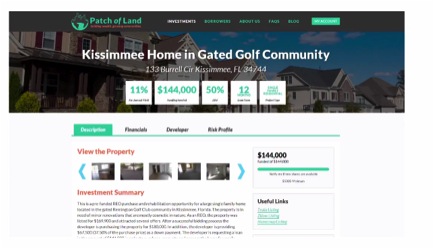

Upon logging into Patch of Land, and selecting a potential investment project, you will be able to access property details, view pictures, and review an investment summary. If you decide this may be a good fit, you can move forward by reviewing the detailed financials available for all potential investments. Additionally, projected distribution timetables and figures are available to help you estimate the potential payout, return, and investment horizon for your specific project.

When you are ready to move forward after reviewing the financial data, you can move on to an interactive process of borrower due diligence. We encourage you to review details regarding the borrower, their previous projects with Patch of Land, and even ask questions to the borrower and review questions your fellow-investors have asked.

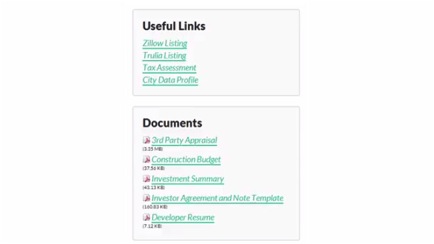

If the project looks like a good fit for investment portfolio, proceed to viewing the due diligence and informative documents like appraisal and surrounding property information.

Here you will find comparable listings like Trulia or Zillow data, city data, proof of insurance, and even the actual note you would get from Patch of Land for the property, as well as additional financial information.

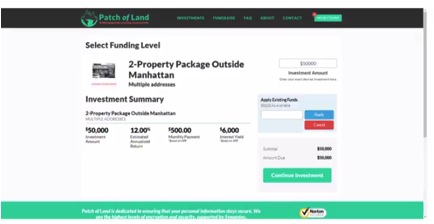

Ready to invest? Simply enter the amount you wish to invest, add it your cart, review the accompanying legal documents, and check out. It really is that simple!

If this reminds you of a simple check out experience, we’ve done our job and have delivered the easy, transparent, and customer-centric experience that Patch of Land was founded upon.

Depending on whether you are a first-time investor, or making your subsequent investment with Patch of Land, you will be guided step-by-step through the completion of the required forms for your investment, and will then e-sign where necessary to complete the transaction. Upon e-signing, you will received the digitally signed documents for your files, and are ready to submit your order.

Yes, it really just took ten minutes for you to invest in real estate!

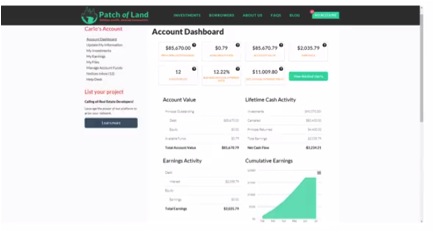

Now proceed to your account dashboard. You’ll be excited to check into your account dashboard every month to see your interest distributions, as well as any capital distributions when the loan is completed by the borrower.

Here, you can see review earnings, download your files and tax returns to do year-end reconciliations, as well as manage account funds. Feel free to manage your investments here, as well as your personal information, and conduct withdrawals to your linked external accounts as often as you’d like – all free of charge.

We invite you to invest with us and we welcome your feedback.