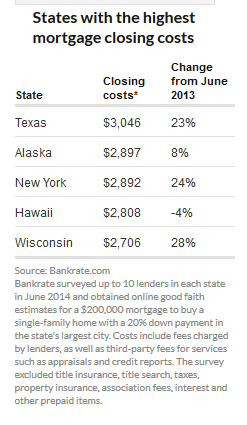

Despite the average rate for a 30-year loan dropping to 4.1%, homebuyers are feeling the pain of increased closing costs. According to Bankrate.com, the average nationwide closing cost on a $200k loan, with a down payment of 20%, was $2,539 this past June. That signifies a nationwide increase of 6% from just a year ago. Those buying homes in Texas, New York and Wisconsin saw some of the biggest increases in the country. Using the same $200k loan with 20% down, closing costs in Texas went up 23% to $3,046, New York rose 24% to $2,892, and Wisconsin soared 28% to $2,706!

So why the big hike in closing costs? Thanks to new federal regulations, mortgage borrowing has become laden with guidelines in order to help reduce the risk of loans potentially going into default. Now, lenders are being required to scrutinize a borrower’s credit history with a fine tooth comb in order to make sure they don’t have any immoderate debt, as well as the ability to prove that their income is sufficient to finance their payments for the foreseeable future. Ultimately, the increase in regulation has led to extra costs for the lender, in the form of manpower and time spent, which are then being passed on to the borrower during close.

To help understand the root of the increase, Bankrate broke down closing costs into two distinct categories. The first one being lender origination fees, which showed an increase of 9% year-over-year to an average of $1,877. The other category included: third-party fees for appraisals, credit reports, and other services, which hit an average of $662. Comparatively, other closing costs (title search & insurance, taxes, and other prepaid items) were not included in Bankrate’s categories since they found them to be relatively stable after the new regulations took place.

Unfortunately, Bankrate’s senior mortgage Analyst Plyana da Costs said the lenders she spoke with do not anticipate lowering their fees for now. The reason being, many mortgage companies and lenders are feeling the burden of staying in compliance with the new rules and regulations. In fact, some are paying a pretty penny to implement fraud check systems, amongst other software, leaving many companies with outdated technology at a competitive disadvantage.

As a leading real estate crowdfunding portal, we consider the way we leverage technology as one of our strongest assets at Patch of Land. Our sophisticated in-house technology was designed to control the process of how a project goes from application to an interest-paying loan listed on the platform. All applications are immediately scored by Patch of Land using both attribute-based business rules and partner data. We pull in information from a number of respected & reliable sources, which is ultimately scored and organized into reports our underwriting team can use to perform our due diligence with far less manpower and time spent. As a result, we are able to keep our rates extremely competitive, making our platform an ideal location for borrowers to gain access to capital funds fast and efficiently.

How do you feel about the increased closing costs? Do you think the federal regulations will soften over time? Do you believe technology will play an important role in the real estate industry going forward? Leave a message and let us know what you think!