Buying an investment property in a high-quality neighborhood doesn’t mean a residential real estate investor must sacrifice returns if they know where to look and are willing to invest outside their own community.

Home flippers and buy-to-hold residential real estate investors, in fact, can obtain stellar returns with lower risk in these high-quality neighborhoods if they know where to look for properties with reasonable prices.

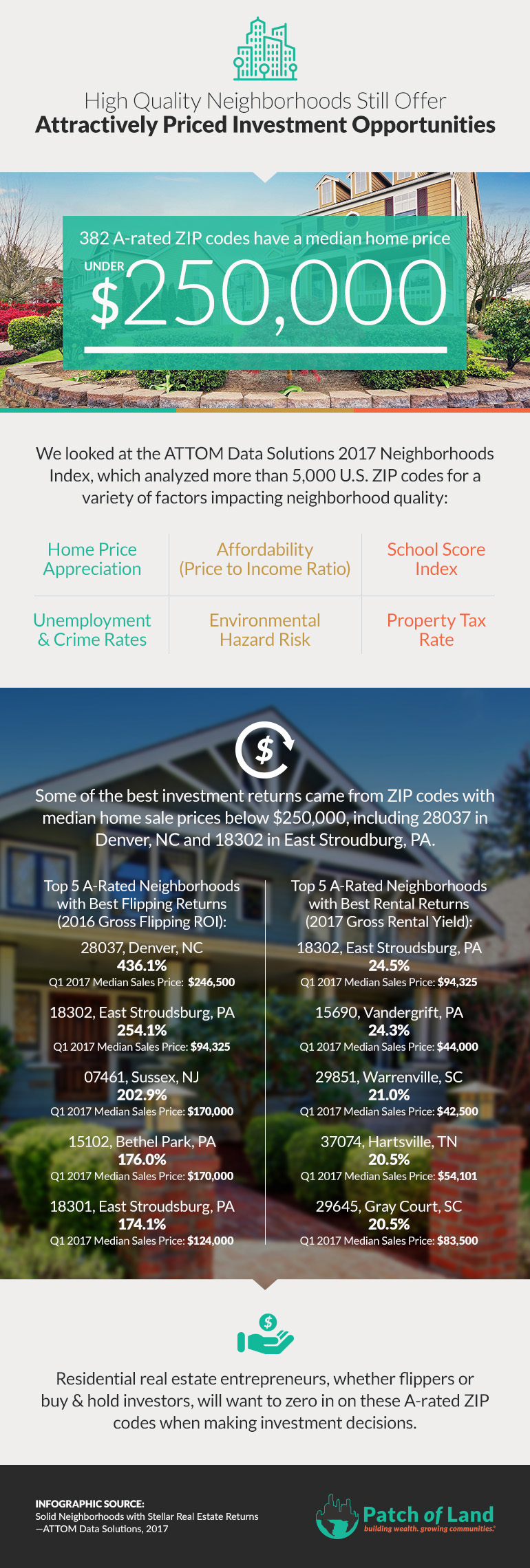

To find out where these neighborhoods are located, we looked at the ATTOM Data Solutions 2017 Neighborhoods Index, which analyzed more than 5,000 U.S. ZIP codes for five factors impacting neighborhood quality: home price appreciation, affordability (price to income ratio), school scores, crime rate, unemployment rate, environmental hazard risk, and property tax rate, with double weight in the index for school scores, crime rate and affordability.

Among more than 1,000 ZIP codes with an A rating, the median home sales price in the first quarter of 2017 was $410,684 on average. However, with a closer look, ATTOM determined that the median sales price in 382 of those ZIP codes was under $250,000 and 27 ZIP codes had a median sales price below $100,000.

Article continues below

Stellar Returns in These ZIP codes

A gross flipping return on investment of 436.1%? Yes, that was the gross ROI last year in ZIP code 28037, which covers Denver, North Carolina, a small town northwest of Charlotte, along the west shore of Lake Norman. The Q1 2017 median sales price was $246,500.

The best ZIP code for rental returns was 18302 in East Stroudsburg, Pennsylvania, where the 2017 potential gross rental yield is 24.5%. The Q1 2017 median sales price was $94,325. This ZIP code also scored high for flipping returns, with a flipping ROI of 254.1%.

Check out this ATTOM Data infographic to see the strongest flipping and rental returns from the index. Residential real estate investors, whether flippers or buy-to-hold investors, may also want to look at this heat map, which allows an investor to zero in on a specific city and ZIP code and obtain a variety of interesting data that may assist in making investment decisions.