As more of the millennial generation hits their 20s and 30s, the demand for rental housing and entry-level homeownership in the United States is set to soar.

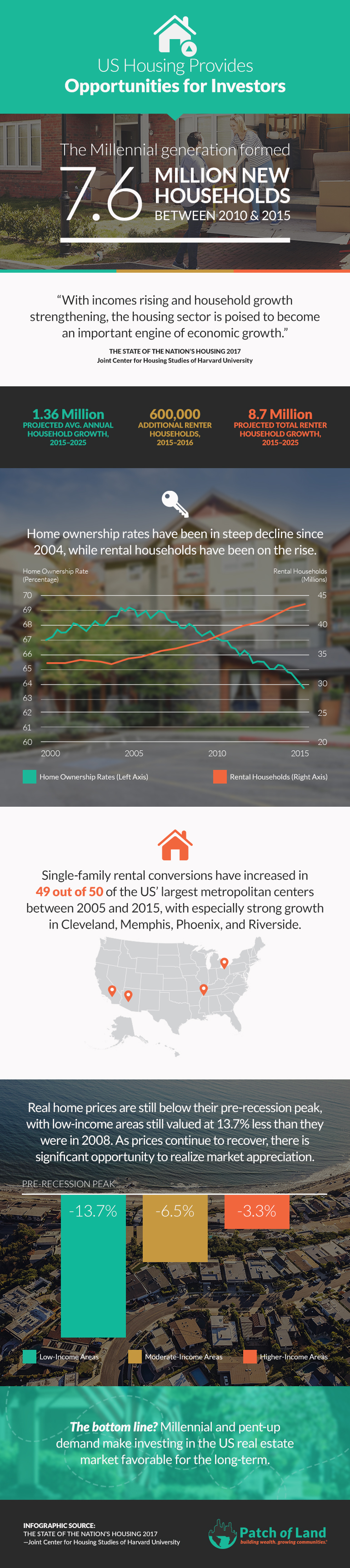

“The State of the Nation’s Housing 2017,” a report released by the Harvard Joint Center for Housing Studies, notes that the millennial generation is reaching the age when many begin to leave their parents to live on their own. This generation formed 7.6 million new households between 2010 and 2015.

The Harvard report has some positive news for the housing industry. The housing market is finally returning to normal a decade after the 2007 housing crisis sent foreclosures skyrocketing and homeownership plunging.

“With incomes rising and household growth strengthening, the housing sector is poised to become an important engine of economic growth,” the report said, although it noted that significant challenges remain such as affordability and inventory constraints. While housing prices have rebounded, price appreciation hasn’t been evenly distributed, and home prices in lower-income areas are still 13.7% below their pre-recession peak.

Investment opportunities

We believe data in the report supports significant residential real estate investment opportunities on the horizon. Both fix-and-flip and buy-to-hold investors should have plenty of opportunities as the millennial generation forms new households and seeks to rent single-family residential homes as an alternative to multifamily apartment living. On the other end of the market, we are seeing a large number of Baby Boomers choosing to leave their large, now empty suburban homes in favor of down-sizing and many choosing to rent rather than own.

Growth in U.S. households is now projected to reach 1.36 million in 2015–2025, roughly in line with the increase in the 1990s. The homeownership rate, which has declined for 12 years, may have reached the bottom in the first quarter of 2017, when the rate stood at 63.4% — little changed from where it was two years ago.

The growth in renters continues to outpace the growth of homeownership, but both are on the rise. The number of homeowner households rose by 280,000 in 2016, the strongest showing since 2006, according to the report, and the upswing is expected to continue. Rental households rose by 600,000 last year, keeping alive a 12-year streak of renter household growth.

The Joint Center report suggests that demand for owner-occupied housing could rebound even as demand for rentals remains robust, in what appears to be overall good news for investors as it provides options for both the fix-and-flip and the buy-to-hold investor.

Single-family rentals vs. apartments

Multifamily construction, which began to rise in 2010, took the lead in 2013 in providing more rental housing than conversions of single-family homes. Many of these new apartments are high-end, and there’s a lack of supply to meet the demand for more affordable apartments. Austin, Seattle and Portland are among metros that have seen a significant growth in multifamily construction. Nationwide, the typical asking rent for a new unfurnished apartment was $1,478 last year.

Demand for apartments is strong with vacancies at a 30-year low — 6.9% — and rents on the rise in the majority of apartment markets, the Joint Center report indicates.

Conversions of single-family homes into rentals has been a significant story, however. From 2005 to 2015, the single-family share of occupied rental housing increased in 49 of the 50 largest metros. (New Orleans was the exception.) And we’ve seen especially strong growth in single-family rentals in areas with high foreclosure rates and little new multifamily construction such as Cleveland, Memphis, Phoenix and Riverside, California.

Future outlook

With the current pent-up demand and more demand on the horizon from millennials leaving the nest, we see plenty of upside for residential real estate investors in the years to come. It should be noted that all real estate is local, which means some markets may be showing weaknesses while others may be in overdrive. Long-term demographic trends nationwide, however, appear to be favorable to the U.S. housing industry.