Home flips were hot last year, reaching their highest level in 2016 since the pre-recession housing market of 2006, while the number of real estate investors using financing last year climbed to an eight-year high opening up opportunities for alternative lenders in the space.

The potential to lend to residential real estate home flippers is increasing exponentially, said Daren Blomquist, senior vice president at ATTOM Data Solutions, which reported 193,009 single-family homes and condos were flipped last year.

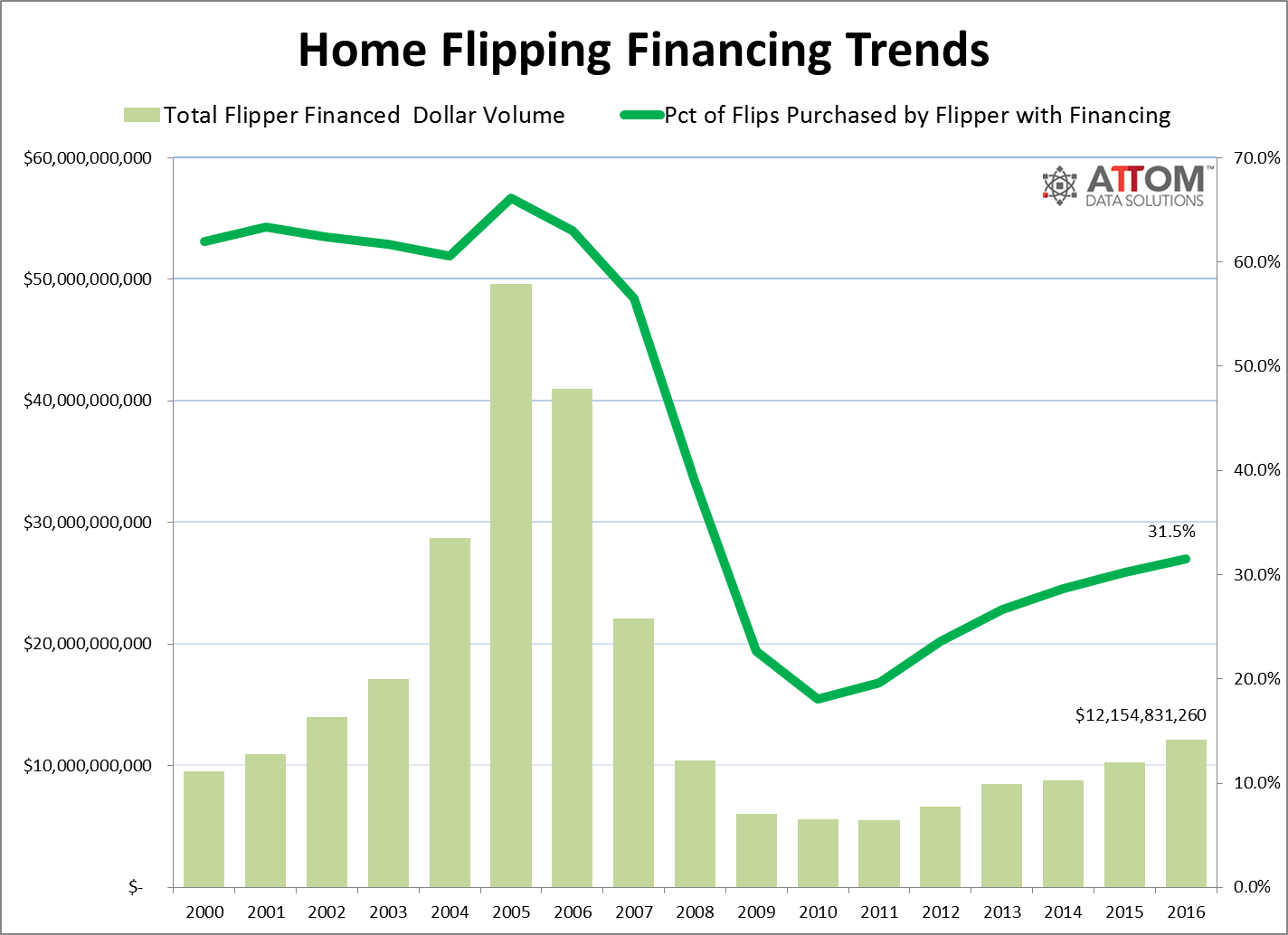

“For a lender catering to home flippers there is still a lot of opportunity,” he said. “The financing market is growing but still has a lot of runway left.” About 10 years ago, about two-thirds of flipping deals were financed compared to just a third today, in part because of today’s tighter post-crisis lending market. That tighter credit market has opened the door for nontraditional lenders who cater to real estate flippers, Blomquist said.

Still, to keep the numbers in perspective, last year’s total number of flips pales to the 276,067 single-family homes and condos flipped in 2006.

The rise in financing for what has traditionally been an all-cash business with some hard-money lending, meanwhile, is an interesting trend.

“The combination of more home flips and a greater share of financing for flip purchases resulted in a 19% jump in the estimated dollar volume of financing for home flip purchases, up to $12.2 billion for the flips completed in 2016 — a nine-year high,” Blomquist said.

California, Florida and Tennessee metros saw the greatest home flipping rate as a percentage of all home sales: Memphis, Tennessee (11.7%); Clarksville, Tennessee (10.1%); Visalia-Porterville, California (10.1%); Tampa-St. Petersburg, Florida (9.9%); and Deltona-Daytona Beach-Ormond Beach, Florida (9.9%).

Several other Florida cities also had flipping rates that exceeded 7%: Miami, Orlando and Jacksonville. Pennsylvania, Ohio and Louisiana produced the biggest gross return on investment: 108%, 90% and 81.2% respectively.

ATTOM Data also notes that 39 ZIP codes, where a minimum of 10 flips occurred, had a flipping rate of 20% or more. Memphis; Miami-Fort Lauderdale-West Palm Beach; and Los Angeles metro areas all had multiple ZIP codes where this trend could be seen.

It’s interesting to note that the size of the homes being flipped declined last year while the age of the properties rose, a likely result of real estate investors going into secondary and tertiary markets to find properties at deeper discounts. These smaller and less expensive homes also drew a larger share of FHA buyers, nearly 20%, a four-year high.

ATTOM Data defines a home flip as a property that is sold in an arms-length sale for the second time within a 12-month period based on publicly recorded sales deed data.