Crowdfunders’ alternative lending solutions add value to the marketplace.

Borrowers investing in single family residential real estate now have access to more alternative funding sources than perhaps any time in U.S. history.

Part of that opportunity comes through crowdfunding, which appeared around 2003 when Brian Camelio, a Boston-based musician, started ArtistShare, a website where artists could seek donations from their fans to produce recordings, according to authors David M. Freedman and Matthew R. Nutting in “A Brief History of Crowdfunding.” The authors called it the first instance in which crowdfunding — seeking multiple small donations via an online platform — gained significant traction in the United States.

Since then, many types of crowdfunding companies have emerged, including platforms for investing in commercial real estate, single-family residential property mortgages and all types of business startups.

Since those early days, real estate crowdfunders — or peer-to-peer alternative lenders — have positioned technology and transparent platforms to investors as part of their strategy to generate awareness when few understood or had even heard of crowdfunding. It worked. The combination of online technology coupled with the opportunity for groups of like-minded people coming together to fund a business, product or service combined American capitalism, entrepreneurship and ingenuity into a very marketable package. Crowdfunding quickly won a following and became a viable form of alternative investment capital.

Real estate crowdfunding is still fairly new to the game with many platforms just a few years old. These platforms continue to offer innovative methods for financing real estate for borrowers and provide investors opportunities to diversify their portfolios.

According to alternative finance and data analysis firm Crowdnetic, which publishes an annual report on crowdbased offerings and transactions, “Real estate is a tangible and well-known commodity with a proven track record in the long term, and it continues to generate strong investor demand.”

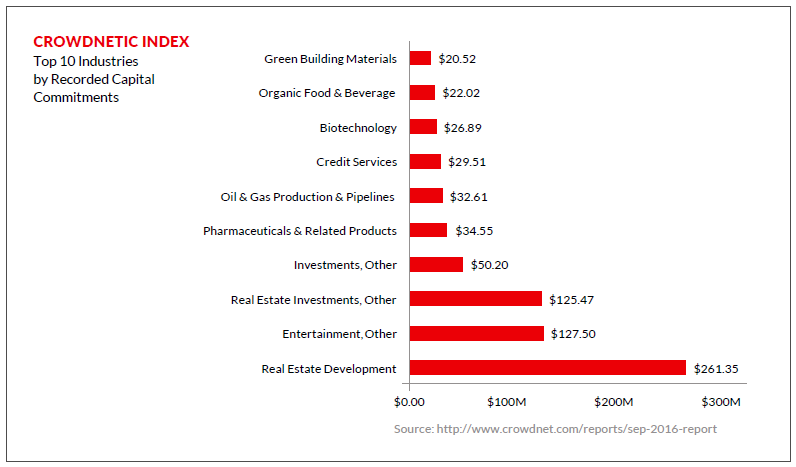

The report continues, “Real estate development and real estate investments have combined through Year 3 to account for more than $386 million in capital commitments, representing more than one-fourth of aggregate capital commitments across all industries. It is also interesting to note that only three industries (real estate development, real estate investments and entertainment/ other) appear on both lists, indicating that the companies that are attractive to entrepreneurs are not necessarily the same ones that are attractive to investors.”

As indicated below, the real estate debt-based crowdfunding sector has two distinct groups of constituents that it must satisfy: investors and borrowers (or real estate entrepreneurs). The key to success is finding a balance in the marketplace that informs, educates and attracts both constituencies while clearly articulating the value proposition of crowdfunding.

To be sure, reaching and appealing to investors is what initially made this new form of alternative financing exciting. Young platforms needed investor buy-in to make the concept viable for borrowers. As real estate crowdfunding matures, it seems that now is a good time for crowdfunding platforms to focus even greater attention on borrowers.

PROVIDING VALUE TO THE BORROWER

Over the past few years, alternative lenders such as hard-money shops, assetbased lenders and crowdfunders have rushed to fill a lending void caused in part by the tightening of the credit box at traditional lenders.

Bank regulation increased significantly after the 2008 financial crisis, which has affected the willingness and ability for big banks to lend. These institutions were blamed, in part, for the mortgage meltdown and have paid millions in settlements. They are only now coming up for air — eight years after the crisis.

The nation’s big banks are still working to reduce the stigma from the foreclosure crisis, which continues to linger. All of this has had the effect of reducing financing options for borrowers. In addition to the issues at big banks, many small community banks have exited the residential mortgage business altogether as economies of scale enjoyed by larger institutions make it hard for them to compete and as added regulations increase cost.

As a result of these post-crisis issues, alternative lenders began to see opportunities to come into the market and add value — reaching borrowers who either couldn’t qualify under new, tighter lending restrictions or who needed an alternative to traditional lenders.

Unlike most hard money lenders, who generally lend in a metro area close to their home base, real estate crowdfunders are typically national in scope and operate using highly sophisticated technology platforms. This national footprint, combined with state-of-the-art technology, is a huge differentiator that opens up new opportunities for both borrowers and investors around the country.

Traditional mortgage lenders want to know a borrower’s individual credit history and require W-2 income from the past two years, and typically won’t allow borrowers to have loans outstanding on half a dozen properties at one time, which is a common practice among professional flippers.

Therefore most real estate investors have been forced to depend on a hodgepodge of small private lenders, wealthy investors or friends and family to provide much needed capital. Real estate crowdfunding platforms enable flippers to tap into a much larger network of investors eager to participate in funding all types of real estate deals. The platforms are typically open to accredited investors, who make more than $200,000 annually or have a net worth of at least $1 million.

Crowdfunders, particularly, bring positives from both the traditional big bank model and the hard money model. They have a similar national footprint to the big, national banks without the brick-and-mortar retail shops. At the same time, crowdfunders offer the nimbleness and flexibility of smaller, local hard money shops that typically allow them to fund loans quickly. Their technology platforms, meanwhile, provide efficiencies that are not often found at many small to midsized banks or with hard money lenders.

WHAT CROWDFUNDING MEANS FOR BORROWERS

Because the real estate crowdfunding space is still so new, borrowers may be confused about the concept of crowdfunding. They may wrongly assume they have to wait for a “crowd” of investors to materialize before their loan will be funded.

Today, real estate crowdfunding sites like Patch of Land take a first-lien position and fund borrowers’ loans, often in a week or even less. Once the loan has funded and the borrower has received funding, crowdfunders offer their “crowd” (accredited investors) the opportunity to buy into the loan in bits and pieces, typically with a minimum investment as little as $5,000.

Borrowers only need to apply and the lending process is assisted by sophisticated online technology, making it quick and relatively easy to fund loans. To be clear: borrowers do not need to be concerned with attracting investors. The platform does that. The value proposition here cannot be ignored. Getting a loan through a traditional lender can often take 30 days or more, especially if the customer isn’t a typical W-2 borrower with a high credit score.

While we have often gravitated toward the term “crowdfund” we may have inadvertently confused borrowers or driven them to other sources of loan funding due to confusion about how crowdfunding actually works and how a loan gets financed on a crowdfunding platform.

At Patch of Land, we’re strongly committed to our crowd and expect to see the number of investors participating in real estate crowdfunding continue to grow at a healthy pace. However, it is important to clearly articulate the opportunity that crowdfunding provides without confusing potential borrowers.

For example, Kickstarter and GoFundMe — among the most well-known crowdfunders on the Web today —have “rewards” models that are far different from how real estate debt crowdfunders work. This can cause confusion for a first-time potential borrower visiting a real estate crowdfunded website.

Under the Kickstarter and GoFundMe models, a “borrower” advertises the investment opportunity to investors to raise the money needed for their business, project or event. The project or event may never get off the ground if enough investors don’t buy into it. Not so with real estate crowdfunding. Loans to borrowers get approved and funded before the loan is ever offered to investors.

Envisioning ways to take advantage of crowdfunding’s popularity while differentiating ourselves from consumer-based “rewards” sites will be critical to alternative lenders’ long-term success in attracting both borrowers and investors.

Each of the real estate crowdfunding platforms has its own characteristics and niche services with investments and loans that include commercial real estate, residential purchase and refinance, fix-and-flip and rental portfolio loans. While some attributes are shared among the different platforms, they aren’t cookie-cutter operations. Each is looking at unique ways to attract its respective constituents.

CONCLUSIONS

As we prepare to enter a new year, there has never been a better time for borrowers to consider alternative lenders in the crowdfunding space. As crowdfunders work to attract new borrowers, it’s important to clearly articulate the value that real estate crowdfunding platforms offer — a national footprint, and efficient technology that allows for quick lending decisions.

Exposing potential customers to the value proposition of real estate crowdfunding has the potential to attract customers who previously have not considered alternative financing or alternative investments.

The real estate crowdfunding industry is now wide open for business.

This contributed article originally found on: Private Lender.