Many people are still unfamiliar with alternative lending. Quite often inquiring minds will ask what the borrowing process is like at Patch of Land, and what are the benefits that come along with it? To help people understand the concept, we have summarized our answers for you, explaining how Patch of Land makes the loan process as convenient and efficient as possible for our borrowers.

Related: Top 10 Crowdfunding Questions Whitepaper

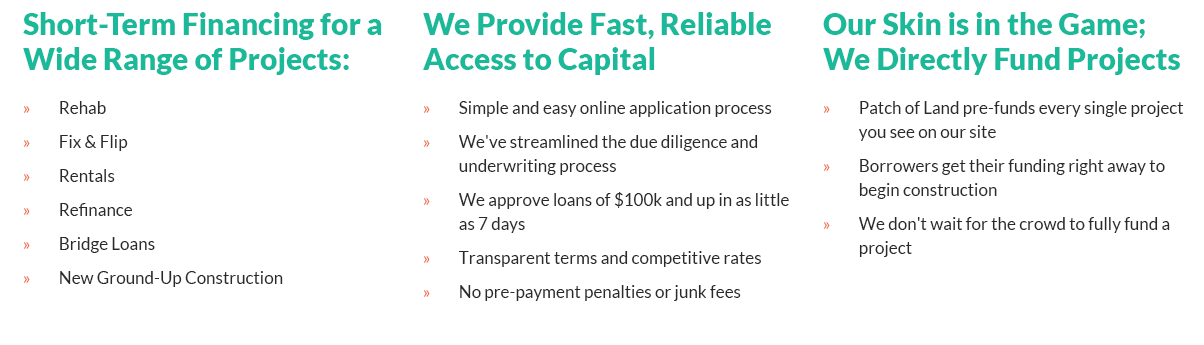

At Patch of Land, we are able to complete funding in as little as 7 days, with short-term rates as low as 10.99% and origination fees as low as 2 points. As an online crowdfunding service with thousands of accredited investors, we have the ability to form creative capital structures that will work for your specific plans, covering both hard and soft costs, and with no pre-payment penalties on loans. We are very flexible in trying to find the best loan product that fits a developer’s needs.

In addition, we take great care and pride in promoting the developer on our website to our investors, giving the developer vast exposure to a large group of people who believe in the project, and want to see it succeed. This is a new way of receiving funding, powered by e-commerce and technology in our connected and social world.

Related: RCTV's Interview with Developer Chris Goodson

This frictionless, paperless, and easy to use platform maximizes convenience for developers. That way they can focus all their efforts on completing their projects. Developers receive the benefits of all these forces combined, plus great customer service, and a team that is dedicated to ensuring the developer’s ultimate success.

To date, Patch of Land has had 7 loans repaid in full. Along the way, we are constantly receiving positive feedback from developers about our overall loan process. Please comment below if you have any additional questions or feedback in general about our alternative lending services.

If you still have questions about real estate crowdfunding we encourage you to learn how to use the power of crowdfunding to scale & take your business to the next level by downloading our FREE Real Estate Crowdfunding Borrower Handbook.

Crowdfunding is transforming the way real estate professionals are accessing capital for their projects. By reading this handbook you'll soon discover the numerous benefits alternative lending has over using traditional banks or local hard money lenders.

Patch of Land Will Participate in the REI Expo / The Patch commented January 6, 2015

[…] How It Works For Real Estate. This class will cover a multitude of topics including: the world of alternative lending through real estate crowdfunding, peer to peer rehab lending, the benefits of prefunded real estate […]

The Benefits of Real Estate Prefunding / The Patch commented January 12, 2015

[…] diligence system. This system combines a highly sophisticated computerized scoring engine with a Makes Sense underwriting approach. While the computer generates scores based on hard facts, PoL’s Makes Sense underwriting […]

Chicago’s South Side a Hotbed for House Flipping - The Patch commented March 23, 2015

[…] to Flip? We discuss some of the logistics and offer some insight into getting your deals funded via alternative lending sources like those presented via our platform. If you’re ready to learn more or want to view […]

Janette Vogel commented June 8, 2016

What is your minimum loan amount for an investment property?